We all want to teach our kids that money isn’t everything, but there’s no doubt that being ‘good with money’ will make their future lives a whole lot easier.

Handling coins and calculating with money in real-life situations outside the classroom can really help children see how important it is in daily life… and talking about money is the first step to great skills!

Read on to find out what your child will learn about money at school, and discover our top tips and activities to support their learning at home.

Please note: This advice was written before the lockdowns caused by coronavirus. Please take into account local government guidance on social distancing when trying these activities.

What do children learn at school?

In Reception, your child will use everyday language to talk about money.

During Years 1 and 2, your child will learn the different coins and notes, the symbols for pounds (£) and pence (p), and how to combine coins to make given amounts. They will solve money problems practically, adding and subtracting to give change.

In Years 3 to 6, your child will progress from making change by adding/subtracting pounds and pence separately to recording money using decimals (for example, ‘£1.52’ instead of ‘£1 and 52p’). This ‘£.p’ format is usually introduced in Year 4. Your child will also solve money problems, including multiplying/dividing decimal amounts of money by whole numbers.

Activities to try at home

Here are some ideas for fun, practical activities to help develop your child’s understanding of money and boost their confidence using money in real life.

1. Set up shop

Playing shops at home is a wonderful way of introducing children to the idea of using money through creative play.

Together, decide what to sell – raid kitchen cupboards, toy boxes, or wardrobes to create different types of shop – and price up all the items with sticky notes. For younger children, set prices with penny amounts or whole pounds using numbers they can cope with. Use real or toy coins (or make coin rubbings with paper and crayons to create your own) and take turns to be shopper and shopkeeper.

Have younger children start by just buying one item and counting out the right coins to pay for it. Encourage older children to choose several items and work out totals and change.

Top Tip 1: More online shopping and contactless card or phone payments mean children often don’t see cash being used. Playing with real money can help them recognise different coins and their values.

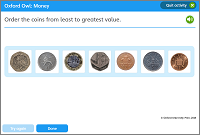

Activity: Sort the coins

Order the coins by value.

2. Be super shoppers

How do you turn a supermarket shop with kids from frazzling to fun-filled? Playing money games that challenge them to be super shoppers might help!

Start by asking younger children to spot and read different prices. (Printing labels when weighing out fruit and veg is a great of providing non-round-number amounts.) As they learn to add amounts, ask your child to find, say, three items that total £5.

Encourage older children to calculate with money by finding the total of your shopping as you add new items to your basket/trolley. In larger supermarkets, handheld scanners offer a fun way to check, but a calculator on your phone works just as well for keeping track on the go. Or you could just challenge your child to see if their total matches the final amount at the checkout!

Top Tip 2: Decimal points in money amounts can be confusing, especially for younger children. Explain that the decimal point separates the pounds and pence, so £2.99 can be read as ‘Two pounds and ninety-nine pence’.

3. Manage a budget

‘Can I have an ice-cream? Will you buy me a new doll/car/dinosaur/hot-air balloon? Can we go to Disneyland, pleeeeease?!’

Even after children have learnt to calculate using money, they often have little sense of affordability! Involving your child in planning family celebrations, days out, or holidays (real or imaginary) can help them to understand the cost of items and activities. It might even encourage them to save for something they want!

Set a budget and research prices together. How much will it cost to get there? Is there a choice of ticket prices? What will lunch/drinks/snacks cost? How shall we divide the budget between party food, decorations, and presents? Don’t forget to talk about the difference between what they need and what they want!

Top Tip 3: When calculating with money, it can be helpful to convert amounts into pence first, before changing back to pounds and pence after the calculation. This helps your child keep track of where the decimal point should go. For example, to add £4.50 + £2.73, you could change the sum to 450p + 273p = 723p, which can then be turned into £7.23.

I hope these ideas have given you some inspiration for exploring money in a memorable way! Have fun!

Activity: My money

Learn how to organise money with this table.

More useful links

- My Money Week: a national activity week in June for primary and secondary schools that provides young people the opportunity to gain skills, knowledge, and confidence in money matters.

- Young Money: resources for anyone teaching young people money management skills.

- NatWest’s MoneySense: fun activities, games, and videos to help your child ‘get money savvy’.